nebraska inheritance tax calculator

This is what the inheritance tax break down should look like. Close relatives of the deceased person are given a 40000 exemption from the state inheritance tax.

Nebraska Income Tax Ne State Tax Calculator Community Tax

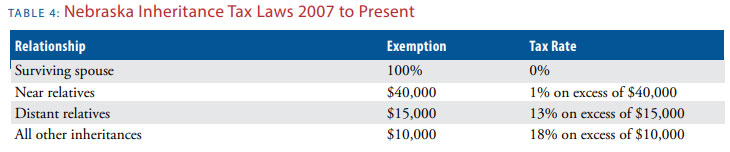

Surviving spouses are always exempt.

. The first thing you need to figure out is your Nebraska income tax rate. Click here for all current and prior IRS revenue rulings. Table S Single Life Factors Based on Life.

The siblings who inherit will then pay a 11-16 tax rate. Nebraska Inheritance Tax Update CAP Series 22-0304 Center for Agricultural Profitability University of Nebraska-Lincoln March 8. The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money.

Ive got more good news for you. Life EstateRemainder Interest Tables REG-17-001 Scope Application and Valuations 00101 Nebraska inheritance tax applies to bequests devises or transfers of property or any other interest in trust or otherwise having characteristics of annuities life estates terms for years remainders or reversionary interests. The tax including interest and penalties is a lien upon any Nebraska real estate until paid.

In addition property that is the subject of either. By contrast a nephew in Iowa has a different tax rate. This entire sum is taxed at the federal estate tax rate which is currently 40.

Nebraska has an inheritance tax. Below we provide a comprehensive look at Nebraska inheritance laws. How is this changed by LB310.

Patricias husband inherits 125000. An inheritance tax is usually paid by a person inheriting an estate. When the decedent leaves behind children how much the surviving spouse is entitled to is dependent on who the childrens parents are according to Nebraska inheritance laws.

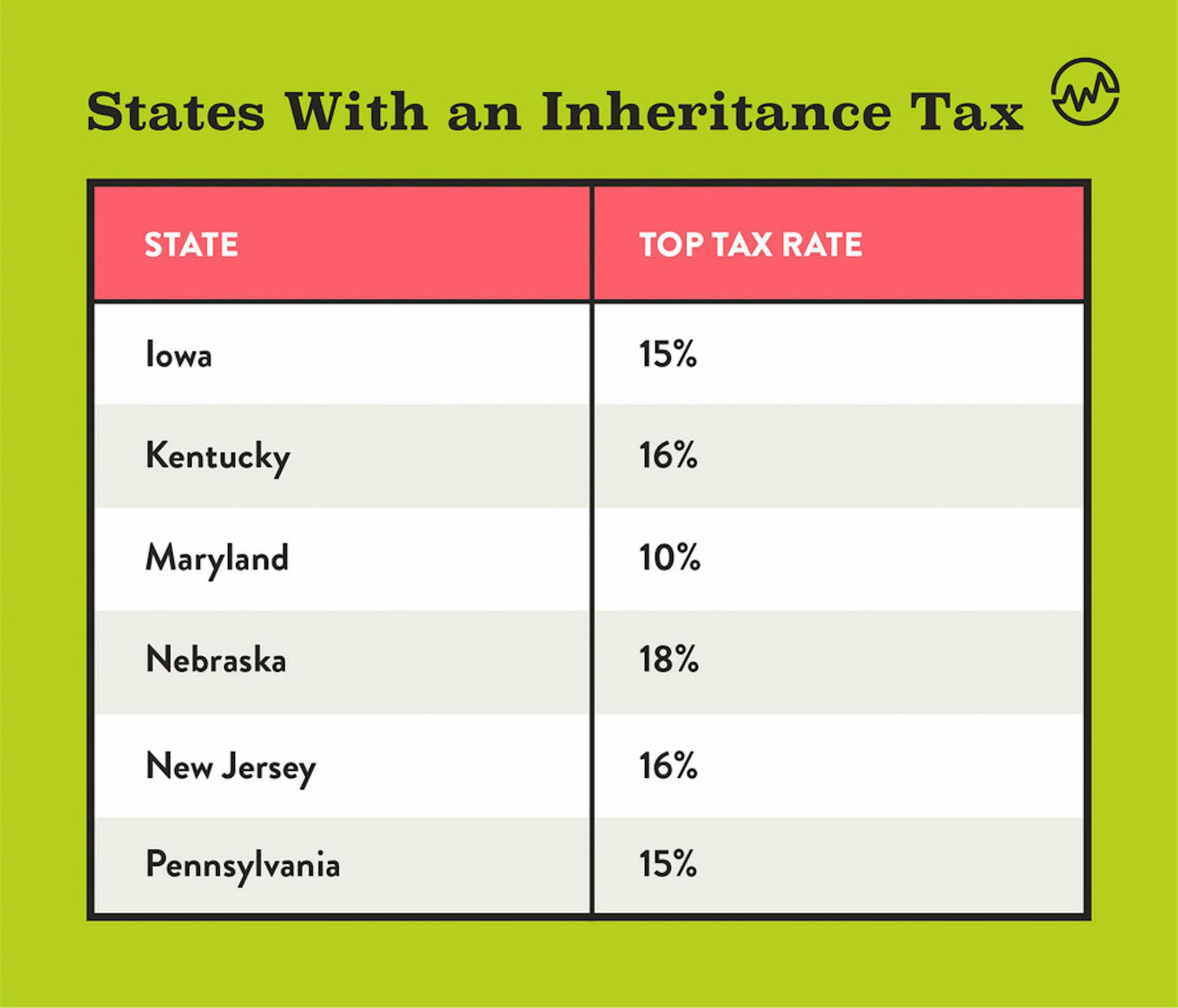

Up to 25 cash back Close relatives pay 1 tax after 40000. For instance if your taxable estate is 15 million then after the 117 million credit 33 million is taxable. Of Nebraskas neighbors Colorado Wyoming South Dakota and Kansas do not have an inheritance tax.

If they inherit more than 40000 a 1 tax will apply to the amount over the first 40000. Patricias son inherits 50000. Under Nebraska rates the five children would pay a total of 9500 while the tax on the nonrelative would be 1774204 II.

Nebraska Gift Tax Inheritance Tax. Generally property may not be inherited until the inheritance tax is paid. Her estate is worth 250000.

State inheritance tax rates range from 1 up to 16. The inheritance tax is due and payable within twelve 12 months of the decedents date of death and failure to timely file and pay the requisite tax may result in interest and penalties. Generally inheritance taxes are paid to the county or counties where the inherited property is located.

The inheritance tax is levied on money already passed from an estate to a persons heirs. Nebraskas inheritance tax was adopted in 1901 before the state had a sales or income tax and has remained relatively the same for the last 120 years. Currently the first 15000 of the inheritance is not taxed.

Patricias husband as a surviving spouse would owe nothing because he is exempt from the. If you leave money to your spouse. Nebraska Inheritance and Gift Tax.

The highest inheritance tax is in Nebraska where non-relatives pay up to 18 on the wealth they inherit. The tax rate and applicable exemption amount varies based on the degree of kinship between the decedent and the respective beneficiary. In other words they dont owe any tax at all unless they inherit more than 40000.

The inheritance tax is due and payable within 12 months of the decedents date of death and a penalty is assessed for failure to file timely the appropriate inheritance tax return. The major difference between estate tax and inheritance tax is who pays the tax. Nebraska Sales Tax Calculator By email protected On September 2 2021 Every 2021 combined rates mentioned above are the results of nebraska state rate 55 the county rate 0 to.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. Nebraska does not have a gift tax. That means the federal government gets to collect 132 million in taxes leaving a total of 1368 million for your heirs.

Late payment of the tax may also result in a hefty interest obligation. Iowa which has an inheritance tax exempts transfers to lineal descendants children grandchildren etc and lineal. Nebraska does have an inheritance tax.

For any amount over 12500 but not over 25000 then the tax rate is 6 plus 625. Not all states do. Nebraska inheritance tax is computed on the fair market.

If every one of the children are that of the decedent and surviving spouse the spouse inherits 100000 of the estate and half of the estates balance. In short if a resident of Nebraska dies and their property goes to their spouse no inheritance tax is due. The rate depends on your relationship to your benefactor.

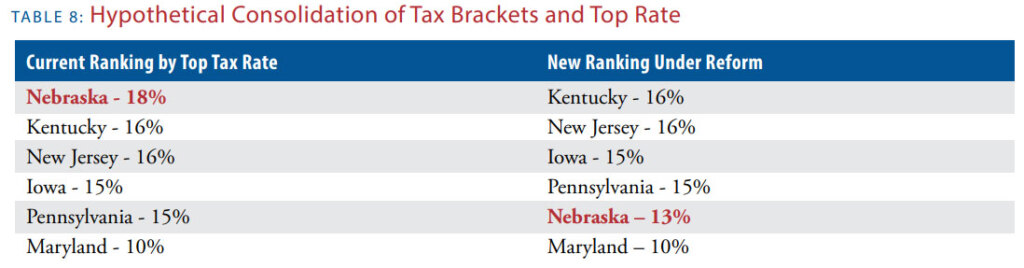

In addition property that is. Beneficiaries are responsible for paying the inheritance tax on the assets they inherit. The exempt amount is increased from 15000 to 40000 and the inheritance tax rate is reduced from 13 to 11 effective January 1 2023.

In Iowa siblings will pay a 5 tax on any amount over 0 but not over 12500. Thus a practitioner is well advised to note that insurance proceeds payable to a specific beneficiary or living trust will not be subject to tax. The first 50000 is taxed at 10.

If it goes to their parents grandparents siblings children or a lineal decedent or their spouse then the tax is applied to anything over 40000 at a rate of 1. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. Anything above 15000 in value is subject to a 13 inheritance tax.

The average salary for. The Nebraska inheritance tax applies to all property including life insurance proceeds paid to the estate which passes by will or intestacy. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

In fact most states choose not to impose a tax on time-of-death transfers. The federal gift tax allows a 15000 exemption amount per year and per person. Most taxpayers pay fall into the second and third tax brackets because of the average income made by Nebraskans.

Nebraska income tax brackets range from 246 to 684Nebraska uses a progressive tax rate system meaning that higher levels of income are taxed at higher rates. However if the exemption amount is lower the executor will calculate the tax due based on the difference applied at a tax rate of approximately 40. If it goes to an aunt uncle niece nephew or any lineal decedent.

If the same rate is in effect for more than one month the link provided above is to the first IRS revenue ruling for that period. Patricias long-time friend inherits 60000. Patricias nephew inherits 15000.

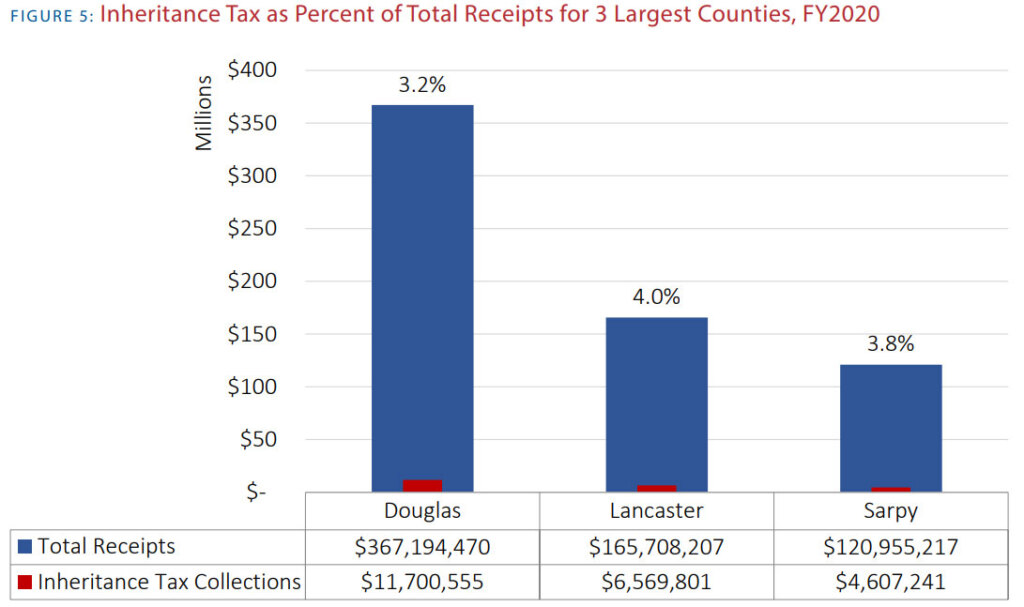

The unique feature about Nebraskas inheritance tax is that it was and still is the only state in the nation to use this tax as a local revenue source. Now for some good news. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

Death And Taxes Nebraska S Inheritance Tax

How Much Money Can You Inherit Tax Free Inheritance Tax Calculator Banks 2022 Daily4mative

Inheritance Tax On House California How Much To Pay And How To Avoid It

Salary Calculator Ky Salary Information Websites

How To Calculate Inheritance Tax 12 Steps With Pictures

Death And Taxes Nebraska S Inheritance Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Nebraska Inheritance Tax Update Center For Agricultural Profitability

Inheritance Tax 2022 Casaplorer

Nebraska Income Tax Ne State Tax Calculator Community Tax

Death And Taxes Nebraska S Inheritance Tax

Nebraska Income Tax Ne State Tax Calculator Community Tax

Calculating Inheritance Tax Laws Com

Maryland Inheritance Tax Calculator Probate

Death And Taxes Nebraska S Inheritance Tax

Nebraska Income Tax Calculator Smartasset